SUBHEAD: Do we as a nation now fear the truth so much that we prefer deception and lies?

By John Schettler on 30 September 2009 in The Writing Shop -

http://www.writingshop.ws/html/stubborn_facts.html

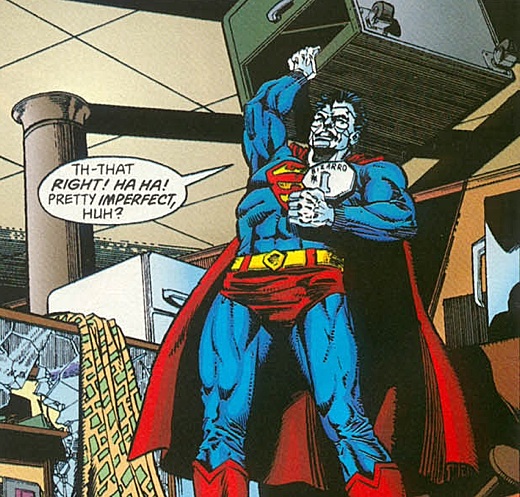

Image above: On the planet Htrae in the Bizarro universe everything is backwards. From http://goodcomics.comicbookresources.com/2009/01/21/a-year-of-cool-comic-book-moments-day-21

A job is more than a simple source of income. A livelihood forms the strong underpinning of one’s identity. It knits people into society and allows them to make a contribution of their individual abilities and talents while providing them the wherewithal to sustain their lives and families.

Unfortunately, job loss has been the greatest calamity of this economic decline, with as many as half a million filing first time claims for unemployment insurance each month.

Analysts have determined that virtually all the new jobs created in the last decade have now been lost. We are back at early 1990s levels for total jobs available, and there are now six unemployed people for each new job created in this economy. The Telegraph reported the ongoing contraction in so many key industries in the US job market:

The job market remains dismal, with the few industries still adding positions slowly becoming saturated. In the age group of the youngest workers, (16-24) , there is now an appalling unemployment rate of 52.2%--more than half of all people who are not students in that category cannot find work! And a third of all people without jobs now have gone unemployed for over 26 weeks.

On top of that, companies have scaled back work weeks to an average of only 33 hours, and many workers have been forced to take time off without pay in order to retain their position. When will this reverse?

Not soon, say analysts in virtually any forum you read about unemployment. What would it take to just get back to where we were in terms of employment during the boom times? In order to get back to employment levels at the peak of the housing boom in 2005-2006, we would have to create a quarter million new jobs every month, for 60 consecutive months. In the last decade the average number of new jobs created per month equaled only 50,000.

And instead of job growth we continue to have a net loss of jobs in the hundreds of thousands each month, and have sustained these losses for over 20 consecutive months so far. In effect, to simply break even the economy would have to perform better than it has in the last 75 years—significantly better. I defy any rational person to assert we are going to have a speedy recovery at that clip when they look at current employment numbers.

Where will the new jobs come from? They are still being lost each month! We have yet to have a single month of positive job growth in the last two years. This single fact, that we have a growing population while we are undergoing severe job loss, with no substantial job creation, means that the “Great Recession” is far from over. If it will take a positive job growth rate of +250,000 per month just to break even by 2014, and we still have not come out of the job loss nose dive we have been in, then don’t expect “recovery” on Main Street for many, many years.

In fact, it would take a positive GDP growth rate between 5% and 10% to create those jobs. We are nowhere near that. The anemic 1% projected growth rate that has all the “economists” carping about the recession being over was largely, if not entirely, created by government subsidies in housing, auto sales and the backstopping of banks in the trillions through TARP and Federal Reserve programs.

In effect, the real economy did not grow at all. Remove this government life support and it would have sustained a remarkable 8.9% decrease in GDP over the last 12 months. And we get no help from the fabled “Small Business” sector, which has long been a backbone of employment and job creation. Stated simply, business startups are reaching new lows.

The Wall Street Journal reported: “Business starts fell 14% from the third quarter of 2007 to the third quarter of 2008; the 187,000 businesses launched in that quarter were the fewest in a quarter since 1995. The number ticked up slightly in the fourth quarter, the latest data available. But those new establishments created only 794,000 jobs, the fewest since the government began tracking the data in 1993.” The Wall Street Journal reported:

Any real recovery must be robust enough to offset job loss, create new jobs, and stimulate new business growth and investment. It is simply not happening. Yet the mainstream media continues to shill for the notion that the recession has ended. Why? Are they stupid? Hardly.

It is simply not in their interest to present the truth to the public, because if people know what is really happening they may demand real change—not the change we have see thus far from the new administration and congress, which has amounted to the greatest continued supplication to the large banking and financial centers in all our history to date—and we have committed more public funds than all national endeavors ever undertaken by this nation combined, including all our wars and major social programs. Yet nothing has changed.

Consider that as you listen to congressmen and senators wrangling over where they’ll find money for your health care. What was good enough for Bank of America and Citigroup is clearly not good enough for you. Blogger Charles Hugh Smith asks a very relevant question in his last post for September:

The argument itself is blatant testimony to all I have been saying about the inherent insolvency of the banking system. It is a system that has been running on liberal loans from Fed programs, government bailout money, and a healthy dose of secrecy and lies. Yet all this money, in trillion dollar truckloads, has failed to really restore balance or solvency. According to the Fed's own admission the mere knowledge of the real condition of bank balance sheets would cause “irreparable harm.” Charles Hugh Smith again comments:

Note that in all of this I have not even mentioned the fact that stocks are up 50% from their lows in this sustained bear rally—up 15% in the third quarter alone. This rally has been manipulated time and time again, and simply cannot be sustained given the real data from Main Street reported above. The markets have become entirely disconnected from the real economy, in fact, entirely disconnected from “fundamentals” that normally guide wise investing. Blogger Karl Denninger’s take on the market is quoted here. Can the rally continue?

Bizarro World - It’s a strange world we live in these days. When I was a kid we used to look forward to Superman comic book episodes in "Bizarro World." It was a place where you had to do everything ass backwards, a cubed shaped planet called "Htrae," (which is earth spelled backwards). First appearing in DC Action Comics issue #263, Wikipedia reminds us:

What a strange world to think that the government now owns and guarantees 80% of the mortgages issued in the former "free market" we call the real estate industry. Yet like the demise of Fannnie & Freddie, the former backers of shaky mortgage paper, the FHA is now seeing a 23% default/delinquency rate in its "portfolio." They might as well just borrow the line from Action Comics: FHA - "Guaranteed to lose money for you!"

And consider the stock market again, where the play de jour is to try and make money by "shorting" stocks in a bad economy--making money from declining fortunes of the companies that issue the stocks. Bizarro indeed! But lately the short sellers have taken a big hit because, in the midst of the worst economic crash since the Great Depression, the stock market has put in a Bizarro Bear rally. All this while real earnings in companies that make up the S & P 500 have fallen off a cliff. Here's a chart from the folks at "Chart of the Day."

Wow! Talk about some nasty fundamentals! Real earnings have taken the worst plunge in the history of the market since 1935! This is the situation behind the big Bear rally we’ve been astounded by. Time to buy stocks in Bizarro world ! And while everyone stands in awe, insiders, those with the big money in the know, are busy selling their stock shares like there was no tomorrow.

So what a world we live in here on Htrae, where public money from the weakest goes to support the bad bets and private investment losses of the wealthiest. And all of this happens with the willing aid of the government that is supposed to be "of the people, by the people, and for the people"... you know, all of the folks out there on Main Street with no jobs or health care.

No money for health care in Bizarro World! We spent it all to bail out the big banks. And all this goes on because our regulators, congressmen and government leaders appear to be stupider than the entire Bizarro police force put together! BIZARRO NEWS!

Unemployment continues unabated, foreclosures are at an all time high, credit is contracting at record levels, banks are failing everywhere, the FDIC is out of money, commerce is slowing to a crawl! It's a recovery! Excuse me. I have to go practice walking backwards.

By John Schettler on 30 September 2009 in The Writing Shop -

http://www.writingshop.ws/html/stubborn_facts.html

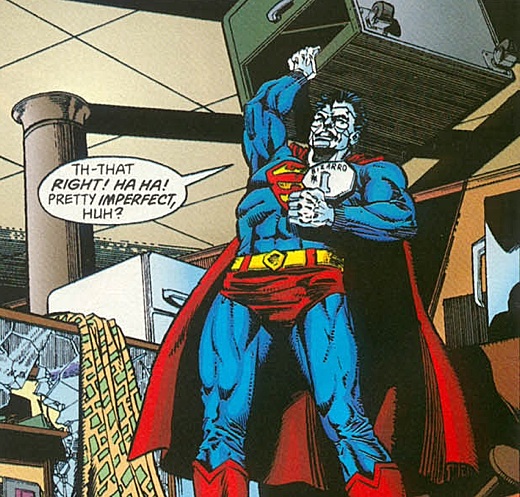

Image above: On the planet Htrae in the Bizarro universe everything is backwards. From http://goodcomics.comicbookresources.com/2009/01/21/a-year-of-cool-comic-book-moments-day-21

A job is more than a simple source of income. A livelihood forms the strong underpinning of one’s identity. It knits people into society and allows them to make a contribution of their individual abilities and talents while providing them the wherewithal to sustain their lives and families.

Unfortunately, job loss has been the greatest calamity of this economic decline, with as many as half a million filing first time claims for unemployment insurance each month.

Analysts have determined that virtually all the new jobs created in the last decade have now been lost. We are back at early 1990s levels for total jobs available, and there are now six unemployed people for each new job created in this economy. The Telegraph reported the ongoing contraction in so many key industries in the US job market:

“Since the end of 2008, job openings have diminished 47 percent in manufacturing, 37 percent in construction and 22 percent in retail. Even in education and health services — faster-growing areas in which many unemployed people have trained for new careers — job openings have dropped 21 percent this year.”The statistics, cleverly masked and watered down by the Bureau of Labor, tell the cold hard tale in mathematics if looked at honestly.

The job market remains dismal, with the few industries still adding positions slowly becoming saturated. In the age group of the youngest workers, (16-24) , there is now an appalling unemployment rate of 52.2%--more than half of all people who are not students in that category cannot find work! And a third of all people without jobs now have gone unemployed for over 26 weeks.

On top of that, companies have scaled back work weeks to an average of only 33 hours, and many workers have been forced to take time off without pay in order to retain their position. When will this reverse?

Not soon, say analysts in virtually any forum you read about unemployment. What would it take to just get back to where we were in terms of employment during the boom times? In order to get back to employment levels at the peak of the housing boom in 2005-2006, we would have to create a quarter million new jobs every month, for 60 consecutive months. In the last decade the average number of new jobs created per month equaled only 50,000.

And instead of job growth we continue to have a net loss of jobs in the hundreds of thousands each month, and have sustained these losses for over 20 consecutive months so far. In effect, to simply break even the economy would have to perform better than it has in the last 75 years—significantly better. I defy any rational person to assert we are going to have a speedy recovery at that clip when they look at current employment numbers.

Where will the new jobs come from? They are still being lost each month! We have yet to have a single month of positive job growth in the last two years. This single fact, that we have a growing population while we are undergoing severe job loss, with no substantial job creation, means that the “Great Recession” is far from over. If it will take a positive job growth rate of +250,000 per month just to break even by 2014, and we still have not come out of the job loss nose dive we have been in, then don’t expect “recovery” on Main Street for many, many years.

In fact, it would take a positive GDP growth rate between 5% and 10% to create those jobs. We are nowhere near that. The anemic 1% projected growth rate that has all the “economists” carping about the recession being over was largely, if not entirely, created by government subsidies in housing, auto sales and the backstopping of banks in the trillions through TARP and Federal Reserve programs.

In effect, the real economy did not grow at all. Remove this government life support and it would have sustained a remarkable 8.9% decrease in GDP over the last 12 months. And we get no help from the fabled “Small Business” sector, which has long been a backbone of employment and job creation. Stated simply, business startups are reaching new lows.

The Wall Street Journal reported: “Business starts fell 14% from the third quarter of 2007 to the third quarter of 2008; the 187,000 businesses launched in that quarter were the fewest in a quarter since 1995. The number ticked up slightly in the fourth quarter, the latest data available. But those new establishments created only 794,000 jobs, the fewest since the government began tracking the data in 1993.” The Wall Street Journal reported:

“So far, much of the government's response to long-term unemployment has been to extend jobless benefits, a support that keeps workers off the streets but can lead some to languish in unemployment instead of searching for work as if it were a full-time job. The federal government extended the standard 26 weeks of benefits by 20 weeks, and to as much as a total of 79 weeks for some workers in high-unemployment states.”Now even those extended benefits are slowly running out. People don’t realize just how bad the situation is, because all these government programs and safety nets have softened the pain. But the government cannot replace the real economy indefinitely. There is a limit to how much money and debt it can create to try and infuse new life into an otherwise dead mainstream economy. Congress is again talking about raising that debt limit, even as the FDIC is loudly whispering that it is practically broke. Yet, in spite of these glaring realities people prefer to believe things are fine and recovery, particularly for the consumer, is nigh at hand. Henry Blodget of the Business Insider hits a simple note of common sense with this quote:

“In order for consumer spending to come roaring back, however, one critical thing has to happen: Consumers have to be employed.”Mark Twain was fond of saying: “Get your facts first. Then you can distort them as much as you please!” So for those of you that prefer reality to fantasy, and have a pragmatic view of life, these are the facts:

- Job loss continues and we have no positive job creation to lead us out of the recession.

- We will need positive job creation at record breaking levels for 60 months just to break even.

- The real economy is therefore not growing at all, but remains severely depressed.

- Retail sales are down year over year. The consumer is not coming back any time soon.

- Business startups are down 14%

- Excess capacity in manufacturing is now over 60%

- Shipping is idled all over the world with indexes at all time lows.

- Production is down in double digit numbers in all the world’s major manufacturing sectors.

- The US housing market is NOT recovering. Prices are continuing to erode.

- 7 million foreclosures are being held off the market by banks.

- $685 Billion in new mortgages were issued this year thru August. (Now look at the next point) • The Fed bought $722 billion in mortgage paper thru August—in effect it backstops the whole RE market!

- Loan default rates at banks have reached an average of 14%

- Loan losses in the commercial sector are just getting started.

- Alt-A and Option ARM loans are facing a huge wave of problems as loans reset to higher payments. • Delinquency rates are now at all time highs, and getting worse each month.

- Credit card default rates exceed 10%

- Debt remain catastrophically high at every level of our society—states, cities, banks, and families. Stated simply, the stubborn fact of the matter is that there is no recovery underway. Period. The media can distort that fact, as Twain so eloquently put it, as much as they please.

Any real recovery must be robust enough to offset job loss, create new jobs, and stimulate new business growth and investment. It is simply not happening. Yet the mainstream media continues to shill for the notion that the recession has ended. Why? Are they stupid? Hardly.

It is simply not in their interest to present the truth to the public, because if people know what is really happening they may demand real change—not the change we have see thus far from the new administration and congress, which has amounted to the greatest continued supplication to the large banking and financial centers in all our history to date—and we have committed more public funds than all national endeavors ever undertaken by this nation combined, including all our wars and major social programs. Yet nothing has changed.

Consider that as you listen to congressmen and senators wrangling over where they’ll find money for your health care. What was good enough for Bank of America and Citigroup is clearly not good enough for you. Blogger Charles Hugh Smith asks a very relevant question in his last post for September:

“Do we as a nation now fear the truth so much that we prefer deception and lies?”I might add that at one point Fed Chairman Ben Bernanke, stolidly resisting attempts to audit the Federal Reserve, spelled out the situation in no uncertain terms. In its effort to maintain the cloak of secrecy that conceals financial wheeling and dealing at the Fed, the consortium of private bankers won a temporary stay of execution on the order to reveal who they’ve been lending money to. In its argument at court the Fed pleaded:

"Immediate release of these documents will cause irreparable harm to these institutions and to the board's ability to effectively manage the current, and any future, financial crisis."So what we have been told, in effect, is that if we tell the truth about the banks the system will suffer "irreparable harm". If we know why banks need Fed funds, which banks need Fed funds, the damage would be so severe that is could not be reversed. That's pretty sobering talk.

The argument itself is blatant testimony to all I have been saying about the inherent insolvency of the banking system. It is a system that has been running on liberal loans from Fed programs, government bailout money, and a healthy dose of secrecy and lies. Yet all this money, in trillion dollar truckloads, has failed to really restore balance or solvency. According to the Fed's own admission the mere knowledge of the real condition of bank balance sheets would cause “irreparable harm.” Charles Hugh Smith again comments:

“The Fed is terrified of transparency for the exact same reason: that the citizenry will be outraged by the squandering of trillions of dollars, the machinations to protect the wealthy few at the expense of the many, and perhaps most damning of all, the utter failure of the Fed's manipulations, prevarications and obfuscations…Thus the current preference for lies, deception, propaganda, magical thinking and denial is deeply troubling, for it suggests America has lost its faith and confidence that it can solve its pressing financial/fiscal problems.”

Note that in all of this I have not even mentioned the fact that stocks are up 50% from their lows in this sustained bear rally—up 15% in the third quarter alone. This rally has been manipulated time and time again, and simply cannot be sustained given the real data from Main Street reported above. The markets have become entirely disconnected from the real economy, in fact, entirely disconnected from “fundamentals” that normally guide wise investing. Blogger Karl Denninger’s take on the market is quoted here. Can the rally continue?

“In the short term, perhaps. One can lie, cheat and steal for quite some time, and the famous saying 'the market can remain illogical for longer than you can remain solvent' is absolutely true…. But in the end the math always wins and fraud is always exposed. It may take years to happen, but it always does….Proceed at your own risk.”

Bizarro World - It’s a strange world we live in these days. When I was a kid we used to look forward to Superman comic book episodes in "Bizarro World." It was a place where you had to do everything ass backwards, a cubed shaped planet called "Htrae," (which is earth spelled backwards). First appearing in DC Action Comics issue #263, Wikipedia reminds us:

"In the Bizarro world society is ruled by the Bizarro Code which states 'Us do opposite of all Earthly things! Us hate beauty! Us love ugliness! Is big crime to make anything perfect on Bizarro World!' In one episode, for example, a salesman is doing a brisk trade selling Bizarro bonds: 'Guaranteed to lose money for you!' Later, the mayor appoints Bizarro No. 1 to investigate a crime, 'Because you are stupider than the entire Bizarro police force put together.' This is intended and taken as a great compliment."Lately I've come to the feeling that we are living on the bizarro world of Htrae instead of Earth. It's apparently a big crime now for a bank to make a loan that is safe and sound all on its own, and doesn't require government backing from the FHA, or packaging into a risk avoiding "security."

What a strange world to think that the government now owns and guarantees 80% of the mortgages issued in the former "free market" we call the real estate industry. Yet like the demise of Fannnie & Freddie, the former backers of shaky mortgage paper, the FHA is now seeing a 23% default/delinquency rate in its "portfolio." They might as well just borrow the line from Action Comics: FHA - "Guaranteed to lose money for you!"

And consider the stock market again, where the play de jour is to try and make money by "shorting" stocks in a bad economy--making money from declining fortunes of the companies that issue the stocks. Bizarro indeed! But lately the short sellers have taken a big hit because, in the midst of the worst economic crash since the Great Depression, the stock market has put in a Bizarro Bear rally. All this while real earnings in companies that make up the S & P 500 have fallen off a cliff. Here's a chart from the folks at "Chart of the Day."

Wow! Talk about some nasty fundamentals! Real earnings have taken the worst plunge in the history of the market since 1935! This is the situation behind the big Bear rally we’ve been astounded by. Time to buy stocks in Bizarro world ! And while everyone stands in awe, insiders, those with the big money in the know, are busy selling their stock shares like there was no tomorrow.

So what a world we live in here on Htrae, where public money from the weakest goes to support the bad bets and private investment losses of the wealthiest. And all of this happens with the willing aid of the government that is supposed to be "of the people, by the people, and for the people"... you know, all of the folks out there on Main Street with no jobs or health care.

No money for health care in Bizarro World! We spent it all to bail out the big banks. And all this goes on because our regulators, congressmen and government leaders appear to be stupider than the entire Bizarro police force put together! BIZARRO NEWS!

Unemployment continues unabated, foreclosures are at an all time high, credit is contracting at record levels, banks are failing everywhere, the FDIC is out of money, commerce is slowing to a crawl! It's a recovery! Excuse me. I have to go practice walking backwards.

2 comments :

Bill Gross yesterday called this the "new normal," we are in for a long period of stagnation at best. Kunstler would call it the "long emergency."

When FASB loosened the accounting rules last Spring 2009, regarding derivatives valuation, that bought us some time, and allows people to delude themselves into thinking things may be alright for a while longer.

But things are not alright and so you see the powers that be testing out population control with things like crowd control at G-20 in Pittsburgh recently and with the supposed H1N1 Swine flu vaccine.

Truly these are weird times where much is not what it seems.

Post a Comment